Operation & Maintenance Subgroup

Operation and maintenance is one of the long term opportunity areas attached to the development of offshore wind in Scotland.

EU video for REPowerEU initiative

Our Power2X Subgroup brings together a mix of offshore wind, oil and gas and hydrogen supply chain companies in a unique combination to help deliver a new industry in Scotland. Our subgroup membership is listed further down this page and they are interested in exploring the role of the supply chain in early stage and demonstration projects for the production of hydrogen from offshore wind.

Hydrogen has become a very hot topic in recent years and more so in recent months as the vulnerability of the UK energy market to global price shocks has increased the potential role for green hydrogen as one answer to our energy security requirements.

Below are listed a number of reports which set out some future scenarios involving hydrogen to help decarbonise the UK economy. While green hydrogen has a role in most these scenarios its scale varies depending on the the reports views on the future cost of green hydrogen.

This set of reports also raise important questions around the application of green hydrogen to aid the decarbonisation of the economy. They show that prioritisation should be given to its use in heavy transport and industry along with tackling the peak heat demand in the winter months.

At the time of their publication energy security was not a factor in some of these future scenarios. World events has shown that fuels that can decoupled us from global market shocks are now more important than ever and green hydrogen has moved to the top of Europe's list of priorities.

The Scottish Government's Hydrogen Action Plan (Dec 2022) already recognised the importance of green hydrogen and saw it providing the lion's share of the hugely stretching ambition of 25GW of hydrogen production by 2045.

The Action Plan calls for 5GW of hydrogen production by 2030 and for 25GW by 2045 split between both blue (derived from natural gas) and green (produced by electrolysis using renewable power) in a twin track approach

ScotGov's Hydrogen Action PlanThe CCC felt that green hydrogen was too expensive a route to decarbonise heat and therefore would play more of a supporting role to achieving the 2050 Net Zero target. This report was published in 2018 when natural gas prices were low and stable.

Hydrogen in a low carbon economyThe ORE Catapult's report looked at production of hydrogen from offshore wind and how our huge wind resource could be tapped for our Net Zero targets without creating a heavy burden for the UK's electricity grid. An electrons versus molecules approach.

Solving the Integration Challenge

Our Power2X Subgroup is involved in looking at alternate products from offshore wind besides the normal electricity to the grid business model.

The X can stand for Gas or Liquid or any product such as green hydrogen, green ammonia or energy storage in general. It also covers the manufacture of green 'drop in' fuels such as methanol, jet fuel and other e-fuels.

The aim of the subgroup is to bring together our members expertise in offshore wind and marry that to the experience of our members from the oil and gas sector who already have knowledge of offshore gas production and gas transport. The subgroup does not want to stop there as we also want to include a further cross sector approach by adding members from the green hydrogen, green fuels and energy storage sectors to bring the necessary supply chain products and skills to enable the large scale production of such 'X' products from offshore wind.

The diagram on the right shows an energy systems approach to future offshore production of green hydrogen from floating wind. Why floating wind? Scotland is rapidly using up its shallower waters delivering our current 10.2GW of fixed wind projects with another 10GW coming in the ScotWind round. The bulk of our wind resource is in deeper waters further from shore and will therefore require floating wind technologies to access this massive resource.

This map, from the OWIC Offshore Wind and Hydrogen report (link given above), shows that the two lowest LCOE bands, £50/MWh and £60/MWh, correspond to a capacity of approximately 675GW.

The latest Contract for Difference auction, Allocation Round 4, was announced on the 7th of July 2022 and we continue to see a reduction in the Strike Price, down to £37.35/MWh for fixed bottom wind. The first ever floating wind project in a CfD round came in with a Strike Price of £87.30, which means that the capacity estimate above becomes feasible once floating wind achieves £60/MWh through deployment at scale. This is what the ScotWind and INTOG rounds will deliver.

The opportunity for an offshore wind/hydrogen supply chain will be huge. Based on a predicted hydrogen demand of 130TWh to 200TWh in 2050 (from the OWIC report above), this would require between 40GW-60GW of offshore wind dedicated to just hydrogen production.

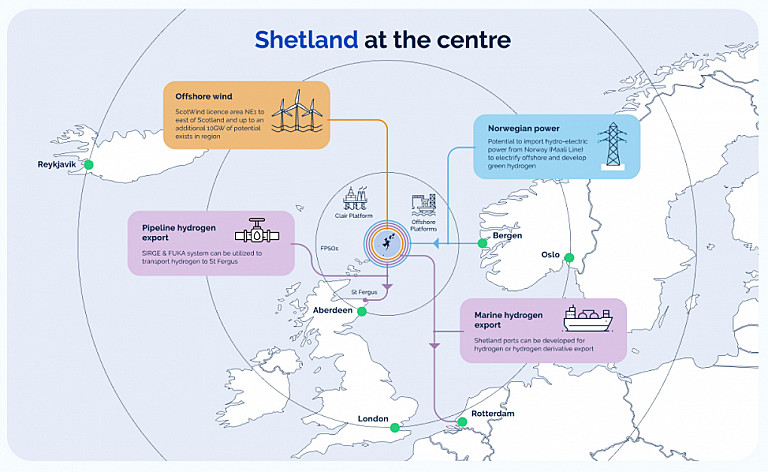

There is also the opportunity to add further capacity to serve a wider Northern European market and create a green hydrogen export market in Scotland. The EU's import target of 10 million tonnes equates to roughly 45GW of offshore wind power. Scotland could deliver 25% of this target by 2035 and 50% by 2040 should a dedicated wind to hydrogen leasing round of ScotWind scale be announced before 2025.

Map image credit: ORE Catapult

Image Credit - Shetland Islands Council

Shetland Islands Council are leading a consortium looking at an energy systems approach to help decarbonise the local oil and gas infrastructure both on and offshore in the Shetland Islands area. The ORION Clean Energy Project consortium strategic partners also include Highlands & Islands Enterprise, University of Strathclyde, and the Net Zero Technology Centre.

Onshore Remote Island Wind of up to 700MW and the three projects on the NE1 ScotWind site totalling 2.8GW, along with a number of proposed INTOG projects, will offer significant opportunity for decarbonisation through electrification as well as green hydrogen production.

Image Credit - Opportunity Cromarty Firth

The Opportunity Cromarty Firth consortium are looking at both onshore and offshore wind as the basis for large scale green hydrogen production. The programme aims to develop a state-of-the-art hub in the Cromarty Firth to produce, store and distribute green hydrogen at scale to the region, Scotland, other parts of the UK and Europe.

One project recently announced sees Scottish Power and Storegga partner up to develop one of the largest hydrogen production facilities in the UK on the Cromarty Firth. The project’s initial phase would see the facility produce up to 34 megawatts (MW) of green hydrogen to be used in heating processes in nearby whisky distilleries.

Image Credit - Offshore Wind Power Ltd

This project will see an industrial scale hydrogen production facility at the Flotta Oil Terminal on the island of Flotta in the Orkney archipelago. Power from the nearby planned West of Orkney offshore windfarm would be brought ashore at the Flotta Terminal to produce green hydrogen at significant scale. This 2GW windfarm is part of the ScotWind round and will be developed by a consortium consisting of Corio Generation, TotalEnergies and RIDG. The partners in the hydrogen hub facility at Flotta include the terminal operator, Repsol Sinopec and Uniper.

This industrial scale hydrogen facility plans to export by ship to Northern European markets and to the UK market by pipeline to the St Fergus gas terminal for onward delivery through the gas transmission network.

Image credit - Western Isles Council

A consortium comprising of representatives from Western Isles Council (Comhairle nan Eilean Siar), Highlands & Islands Enterprise, Stornoway Port Authority, The Stornoway Trust, Lews Castle College (UHI), Community Energy Scotland, SGN (Scottish Gas Networks), Crown Estate Scotland, EDF (owner of Lewis Wind Power), Bay-Wa r.e. (owner of Druim Leathann Wind Farm) and ZC Marine (owner of Pentland Wind Farm) have come together to look at a hydrogen hub project at Arnish on the Isle of Lewis.

The independent gas grid in Stornoway is run by SGN and offers a key potential hydrogen demand asset that could act as a catalyst for wider large scale hydrogen production on Lewis. There is also the potential for nearby ScotWind projects to be involved in hydrogen production but such discussions are at a very early stage.

DeepWind members, Aberdeen City Council and bp, have formed a joint venture to deliver the Aberdeen Hydrogen Hub project which will see a number of hydrogen projects delivered in a phased approach. Phase 1 will target hydrogen production from solar energy to supply green hydrogen to Aberdeen City's fleet of hydrogen buses.

Future phases will see the scale up of production for rail, freight and marine along with the supply of hydrogen for heat utilising the gas grid in Aberdeen. This larger scale production could come from future ScotWind projects on a Power2X basis.

A number of wind to hydrogen projects are already on the drawing board and could link up with the Aberdeen Hydrogen Hub. DeepWind member, Vattenfall's HT1 project will see one of their Aberdeen Bay project turbines be used to produce hydrogen offshore. One of our other members, ERM, are also looking at offshore production of hydrogen with their Dolphyn project which will use a 10MW floating wind turbine to produce hydrogen offshore with a pipeline back to shore at Aberdeen.

These are the only two projects looking at offshore production of hydrogen in Scotland, as yet, and both are looking to connect to the Aberdeen Hydrogen Hub.

Hydrogen is also being looked at as part of the Energy Transition process required to deliver the UK Oil and Gas industry's target of a Net Zero Basin by 2050. A wind/hydrogen approach can deliver the necessary 24/7 offshore energy supply required by the sector to power their offshore production infrastructure.

Subgroup member TechnipFMC's Deep Purple project looks at large scale offshore hydrogen storage on the sea floor with the hydrogen being produced from offshore wind to provide stable power to such offshore infrastructure. The project aims to use floating wind to power a floating electrolysis station, with seabed hydrogen storage, which in turn would power nearby Oil and Gas platforms and subsea infrastructure.

The project has now received funding from Innovate Norway for Phase 1 which will demonstrate some of the necessary technologies onshore in the first instance.

Our subgroup Industry Co-chair is currently David Hogg from Arup as Megan Hine from Draeger had to step back from her role as Co-chair due to a change in circumstances. David has experience in Power to Gas and other technologies from the Power2X stable. This specialist subgroup currently has 155 members but we are keen to grow this membership by adding companies from the oil and gas sector as well as more companies from the hydrogen production and energy storage supply chains.

New companies interested in joining this subgroup should complete our DeepWind membership form here (click this link to open in new tab). Existing members can just flag up their interest in joining the subgroup to the cluster manager, Paul O'Brien.

Explore our other subgroups and the benefits of membership.

Operation and maintenance is one of the long term opportunity areas attached to the development of offshore wind in Scotland.

This subgroup brings together the supply chain elements that make up the major components of floating wind.

From early stage development surveys to all aspects of aerial, surface and subsea inspections, this subgroup covers it all.

Onshore and offshore exports cables, subsea array and dynamic cables, this subgroup covers all aspects of offshore wind cables